Real estate depreciation tax deduction calculator

Since you spread the depreciation deduction over 275 years you take the cost basis of the building not the land and divide it by 275 years to calculate your annual. It provides a couple different methods of depreciation.

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Pin On Real Estate Info Now you need to divide the.

. The maximum simplified deduction is 1500 300 square feet x 5. But with the depreciation write-off aka the number 1 write-off for real estate investors you now only have to pay tax on 6818. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

The new real estate tax assessment values the property at 90000 of which 81000 is for the house and 9000 is for your land. According to the IRS. The depreciation on the rental property offers a tax deduction to be claimed under schedule E of the internal revenue service.

Ad Expertly Manage the Largest Expenditure on the Balance Sheet with Efficiency Confidence. Select Property Type Construction Type Quality of Finish Floor Area Estimated year of Construction Year of Purchase and the Closest Major City to. Depreciation is based on the value of the building without the land.

C is the original purchase price or basis of an asset. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items.

To do this calculation multiply the square footage of your home office up to 300 square feet by 5. Even though you get to keep the entire 9600 because of depreciation you only pay. First one can choose the straight line method of.

Need an Easy Accurate Way to Comply with State Depreciation Across Multiple States. Australian law allows investors to claim tax deductions on both the decline in value of the buildings structure and items considered permanently fixed to the property and the. This is derived from 25000 in rental.

To take a deduction for depreciation on a rental property the property must meet specific criteria. The MACRS Depreciation Calculator uses the following basic formula. For example if a new dishwasher was purchased for 600 had an estimated useful life of five years and would be worth 100 at resale at the end of the five years then the.

So you must allocate 90 81000. D i C R i. Where Di is the depreciation in year i.

You must own the property not be renting or borrowing. Ad Solve Your Legal Problems w Help from Certified Real Estate Lawyers in Minutes. How to use the calculator and app.

Your tax deduction may be limited with high gross income. 275 year straight line depreciation. This depreciation calculator is for calculating the depreciation schedule of an asset.

Tax depreciation is the depreciation expense claimed by a taxpayer on a tax return to compensate for the loss in the value of the tangible assets used in income-generating. Discover Helpful Information And Resources On Taxes From AARP. Real estate depreciation refers to the deductions in the value of a real estate asset to account for the depreciation in its value owing to its use during its lifetime.

Your depreciation deduction is 8000 calculated as 220000 divided by 275 years. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

Straight Line Depreciation Calculator And Definition Retipster

Rental Property Depreciation Rules Schedule Recapture

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

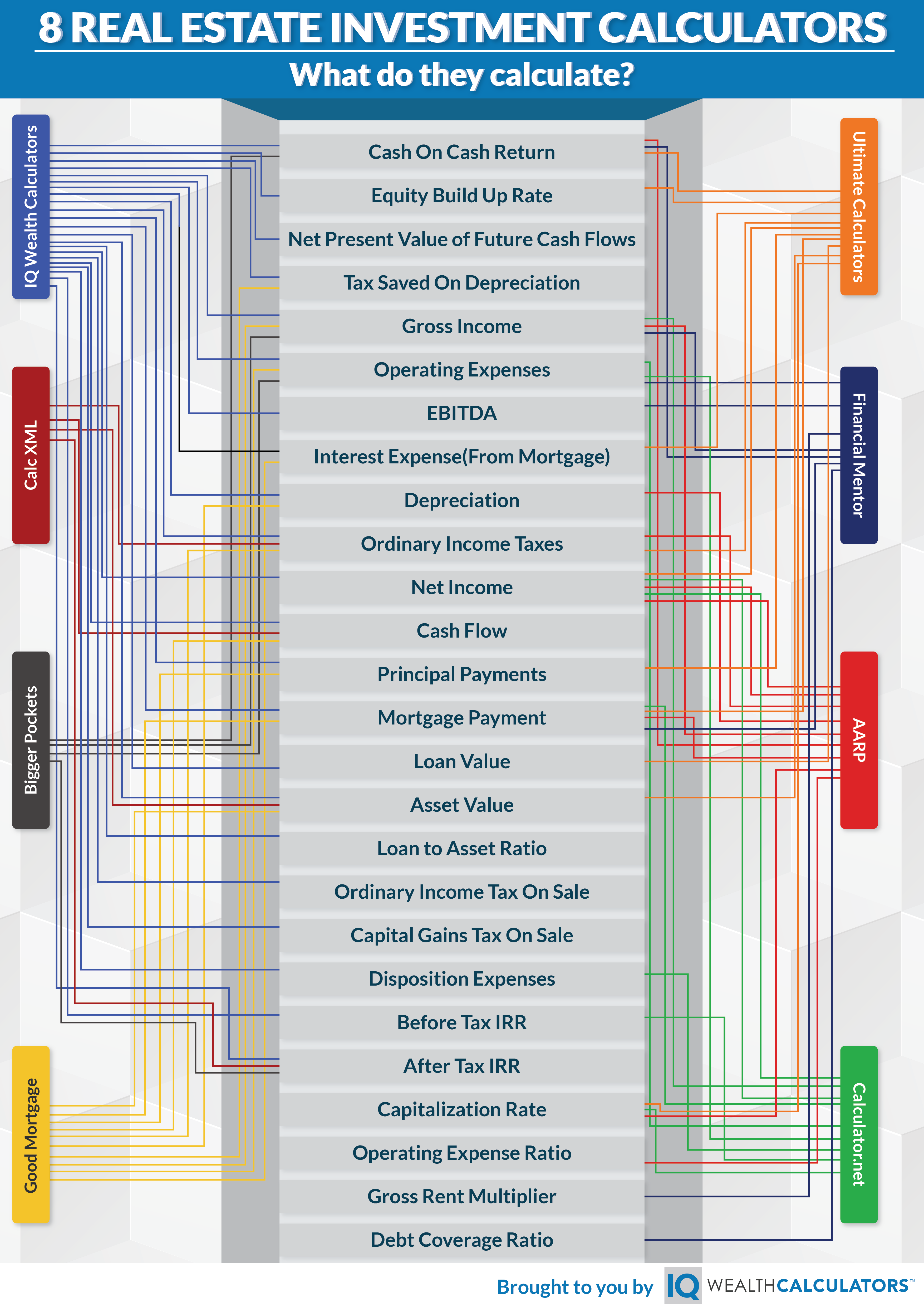

8 Powerful Real Estate Investment Calculators A Full Review

Depreciation Tax Shield Formula And Calculator Excel Template

Straight Line Depreciation Calculator And Definition Retipster

How To Depreciate A Rental Property Formula Excel Example Zilculator Real Estate Analysis Marketing

Free Macrs Depreciation Calculator For Excel

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

8 Powerful Real Estate Investment Calculators A Full Review

How To Calculate Real Estate Depreciation In The Us Vs Capital Cost Allowance In Canada Excel Youtube

Macrs Depreciation Calculator Irs Publication 946

Real Estate Depreciation Meaning Examples Calculations

Depreciation Schedule Formula And Calculator Excel Template

Macrs Depreciation Calculator With Formula Nerd Counter

How To Use Rental Property Depreciation To Your Advantage

How To Calculate Depreciation For Federal Income Tax Purposes Tax Reduction Federal Income Tax Income Tax